Corporate philanthropy excludes any noncash donations. – Corporate philanthropy, a cornerstone of corporate social responsibility, has traditionally excluded noncash donations. This exclusion raises important questions about the scope and impact of corporate giving. This article delves into the rationale behind this exclusion, explores alternative forms of corporate giving, and examines the potential impact and ethical considerations of noncash donations.

Defining corporate philanthropy as the strategic allocation of corporate resources to address social and environmental issues, this article establishes the boundaries of corporate giving and the significance of cash donations within this framework.

Corporate Philanthropy Definition and Scope

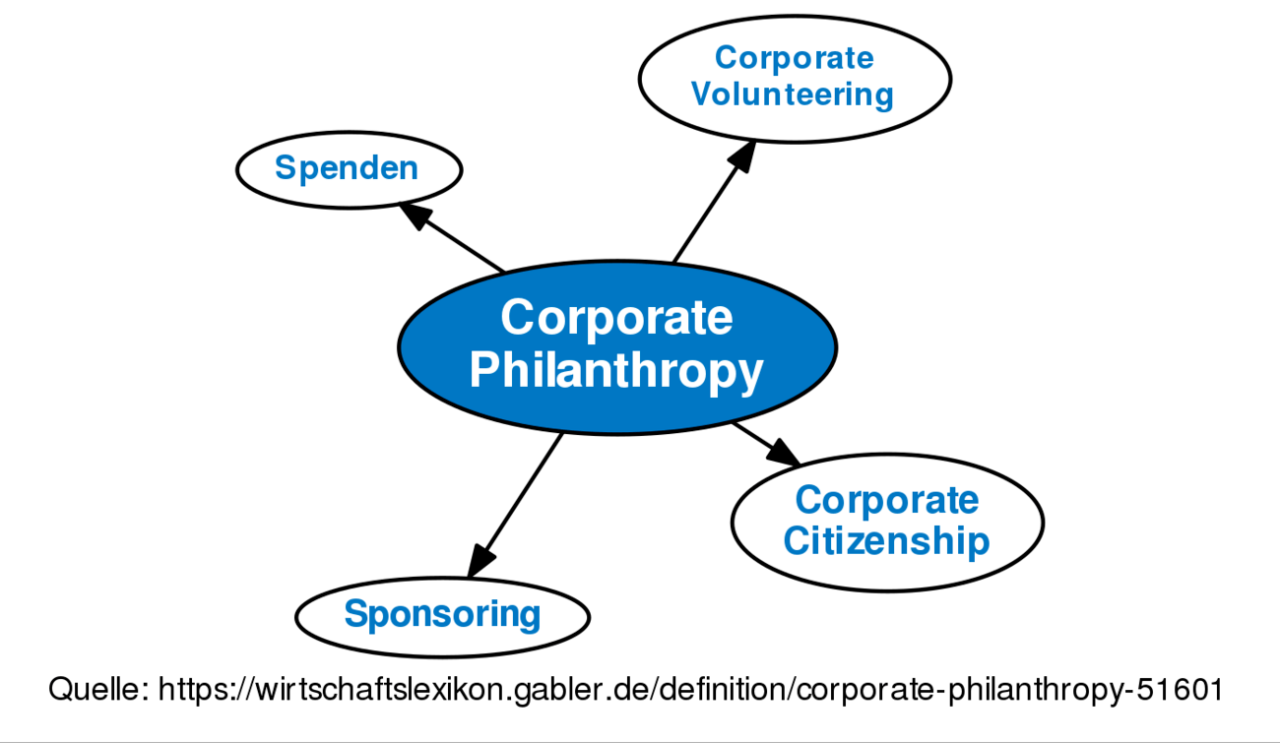

Corporate philanthropy refers to the voluntary giving of resources by businesses to support social and environmental causes. It encompasses cash donations, in-kind contributions, and employee volunteering. The boundaries of corporate philanthropy are defined by the intention of the business to make a positive social impact, rather than to generate profit or achieve other business objectives.

Role of Cash Donations in Corporate Philanthropy, Corporate philanthropy excludes any noncash donations.

Cash donations are a common and direct way for businesses to engage in philanthropy. They provide financial support to organizations working in areas such as education, healthcare, the arts, and environmental protection. Cash donations allow organizations to allocate funds according to their specific needs and priorities.

Exclusion of Noncash Donations: Corporate Philanthropy Excludes Any Noncash Donations.

Noncash donations, such as products, services, or equipment, are typically excluded from the definition of corporate philanthropy. This exclusion is based on the argument that noncash donations are primarily intended to benefit the business itself, rather than to make a direct social impact.

Implications for Corporate Giving Strategies

The exclusion of noncash donations has implications for corporate giving strategies. Businesses may need to carefully consider the balance between cash and noncash donations in their philanthropic portfolios. While noncash donations can provide value to recipient organizations, they may not always be considered as philanthropic activities.

Examples of Excluded Noncash Donations

- Donating surplus inventory to a charity shop

- Providing free advertising space to a nonprofit organization

- Offering employee discounts to a specific social cause

Alternative Forms of Corporate Giving

In addition to philanthropy, businesses may engage in other forms of corporate giving that are not considered philanthropic. These include:

Corporate Social Responsibility (CSR)

CSR refers to the broader concept of businesses taking responsibility for their social and environmental impact. It encompasses a range of activities, such as ethical sourcing, employee well-being, and community engagement.

Cause Marketing

Cause marketing involves aligning a business’s products or services with a social or environmental cause. Businesses may donate a portion of their sales to a specific cause or partner with a nonprofit organization to promote its mission.

Employee Volunteering

Employee volunteering programs allow employees to contribute their time and skills to social causes. This can provide valuable support to nonprofit organizations and foster a sense of social responsibility among employees.

Impact of Noncash Donations

Despite being excluded from corporate philanthropy, noncash donations can have a significant impact on social and environmental causes. They can provide valuable resources to organizations that may not have the financial means to purchase the same goods or services.

Successful Noncash Donation Programs

- Product donations:Many businesses donate surplus products to food banks, clothing drives, and other organizations that distribute them to those in need.

- Service donations:Businesses may offer their expertise in areas such as marketing, accounting, or legal advice to nonprofit organizations.

- Equipment donations:Businesses may donate used or surplus equipment to schools, libraries, or community centers.

Challenges and Opportunities

Measuring the impact of noncash donations can be challenging due to the lack of standardized metrics. However, businesses can track the number of items donated, the value of the donations, and the impact on recipient organizations.

Ethical Considerations

The exclusion of noncash donations from corporate philanthropy raises ethical considerations. It may lead to a bias towards cash donations and overlook the potential value of noncash contributions.

Potential for Bias or Discrimination

The exclusion of noncash donations could lead to discrimination against organizations that rely on noncash support. This may include small, community-based organizations that do not have the resources to secure large cash donations.

Ethical Guidelines for Corporate Giving

To address these ethical concerns, businesses should consider the following guidelines for corporate giving:

- Recognize the value of noncash donations:Businesses should acknowledge the potential impact of noncash donations and consider them as part of their philanthropic portfolios.

- Develop clear criteria for giving:Businesses should establish clear criteria for evaluating both cash and noncash donation requests, ensuring that all requests are considered fairly.

- Foster partnerships with nonprofit organizations:Businesses should engage with nonprofit organizations to understand their needs and identify opportunities for both cash and noncash support.

Detailed FAQs

What are the advantages of noncash donations?

Noncash donations offer tax benefits, reduce waste, and allow companies to support causes aligned with their core competencies.

What are the challenges of measuring the impact of noncash donations?

Challenges include determining the fair market value of donated goods, tracking their distribution, and assessing their long-term impact.