Pay earned after taxes crossword – Embark on a captivating journey into the realm of pay earned after taxes, where we unravel the intricacies of this enigmatic concept. Delve into the distinction between gross and net pay, decipher the role of tax brackets, and master the art of calculating your net earnings.

This comprehensive guide empowers you to navigate the complexities of post-tax income, equipping you with the knowledge to maximize your financial literacy.

From understanding the impact of overtime pay and bonuses to unraveling the influence of employee benefits, this exploration unveils the factors that shape your take-home pay. Prepare to demystify the often-confusing world of post-tax earnings, empowering you to make informed decisions and optimize your financial well-being.

Pay Earned After Taxes: Pay Earned After Taxes Crossword

Pay earned after taxes (PEAT) refers to the amount of an employee’s salary that remains after the deduction of all applicable taxes and other withholdings.

It is the net amount that the employee receives in their paycheck and is distinct from gross pay, which is the total amount earned before any deductions.

Tax Withholding

- Federal income tax

- State income tax (if applicable)

- Social Security tax

- Medicare tax

The amount of tax withheld depends on the employee’s tax bracket, which is determined by their income level.

Deductions and exemptions, such as contributions to retirement plans or health insurance premiums, can also affect net pay.

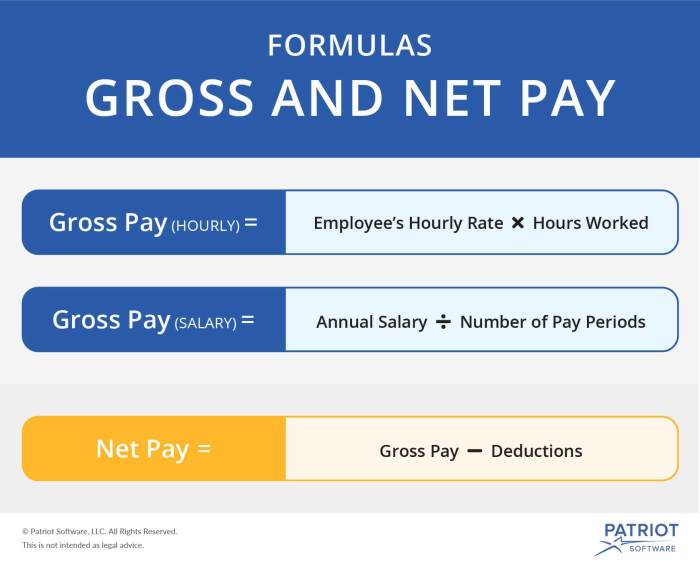

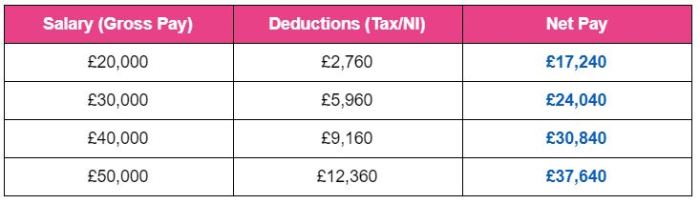

Net Pay Calculation

Net pay is calculated by subtracting all applicable taxes and withholdings from gross pay.

| Gross Pay | Deductions | Withholdings | Net Pay |

|---|---|---|---|

| $1,000 | $100 | $200 | $700 |

Formula: Net Pay = Gross Pay – (Deductions + Withholdings)

Factors Affecting Net Pay

Overtime Pay

Overtime pay is typically taxed at a higher rate than regular pay, which can result in a higher net pay.

Bonuses and Commissions

Bonuses and commissions are taxed differently than regular pay, and their impact on net pay can vary depending on the specific circumstances.

Employee Benefits

Employee benefits, such as health insurance or retirement contributions, can reduce net pay because they are deducted from gross pay before taxes are calculated.

Take-Home Pay vs. Net Pay, Pay earned after taxes crossword

Take-home pay is the amount of money an employee receives in their paycheck after all deductions and withholdings have been taken out.

Net pay is the amount of money an employee earns before any deductions or withholdings are taken out.

The difference between net pay and take-home pay is the amount of money that is withheld for taxes and other expenses.

FAQ Overview

What is the difference between gross pay and net pay?

Gross pay refers to your total earnings before any deductions or taxes are taken out. Net pay, on the other hand, is the amount of money you receive after taxes and other deductions have been subtracted from your gross pay.

How are taxes withheld from my paycheck?

Taxes are withheld from your paycheck based on your tax bracket and the amount of income you earn. The higher your income, the higher the tax bracket you fall into, and the more taxes you will have withheld.

What are some common deductions that can affect my net pay?

Common deductions that can affect your net pay include health insurance premiums, retirement contributions, and Social Security taxes.